Sign In to Your Account

Subscribers have complete access to the archive.

Sign In Not a Subscriber?Join NowThe Financial Situation

How Far Will the Unprecedented Rise in Bonds Go?

MERRYLE STANLEY RUKEYSER

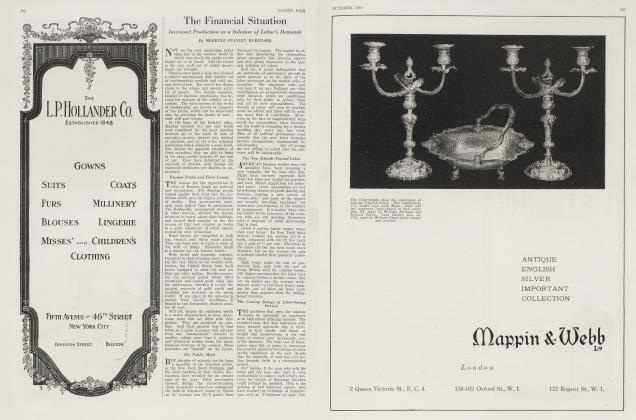

WE have already reached the age of reminiscence in respect to extraordinary bargains in bonds. Investment issues are now on a radically different price level than in the midsummer of 1921. Bond prices have at length reflected a recognition that the world has, in a manner of speaking, returned to the ways of the tranquil. For almost a year, investment securities have fast been demobilizing.

Bonds failed to flourish during the years of strife and the subsequent period of inflation. Bloated bondholders became emaciated and gaunt, while the nouveau riche who owned the stock of war babies suddenly became millionaires. Since the fall of 1919, and more particularly since the spring of the following year, the corrective processes of deflation have wiped out many of the quick war time alterations in the distribution of wealth.

Recession in trade initiated cross currents which in the last ten months, on the other hand, have caused a rise in bond prices, hitherto unparalleled in history. While business was booming, interest rates were unprecedentedly high. Interest rates mark the cost of capital, for which the demand had been extraordinary. The cost of money was all the higher because from 1914 to 1918 much of the world's capital was wiped out.

When the bubble of trade expansion burst, prices collapsed and the volume of commerce shrank. When the full effects of the adjusted status of trade were revealed, the appetite of industry for capital was diminished. With demand tremendously curtailed, the supply of capital was simultaneously amplified as the world returned to productive effort. During 1921 and in the early months of 1922, the changed financial condition was expressed in ever piling bank reserves. Loans and other earning assets of the banks contracted, and the available loanable funds therefore began to overflow. Business, still depressed, was not yet tempted to absorb the funds, and temporarily the banks began in tremendous numbers to purchase bonds at the market place to keep their funds productive until such time as the commercial needs should become large enough to demand them.

THIS rush of band funds into the investment market with the sweep of the falls of Niagara gave fresh driving power to the forces making for rising bond quotations. The swift upward movement began last July. It marked a broad attempt to propel the bond market back toward a vague condition glibly termed normalcy. The rise was infinitely more than a rally. It was a march from abnormally low bond prices and high interest rates toward higher bond quotations and lower interest charges.

For years, the borrower has been at the mercy of the lender. Now, however, the dignity of the borrower is being restored. The investor with $1,000 to lend a corporation can no longer extract wholly one sided terms from the borrower. At the time of writing this article, a purchaser of securities can get only about 5.50 per cent return on his money, compared with 7 per cent in 1920 for a bond equally well secured.

Bond buying is only a single phase of money lending. Throughout the money market, in short term loans as well as long time operations, conditions have become less favourable to the lender. In spite of the revolution in bond values in the last year, bond prices are still cheap, compared with the pre-war average, and tremendously depressed compared with the opening years of the twentieth century when corporate bonds of the highest grade bearing 3 per cent interest coupons were selling at par or higher.

Although the rate of the upturn in the bond market has been so amazingly rapid that it cannot for obvious mathematical reasons continue unchecked much longer, the dominant view among the best banking minds of Wall Street is that bond values have not yet become stabilized, and that present quotations are still singularly low, compared with those that are likely to prevail over a period of years.

From the great counting rooms of America, the advice that the time to buy bonds is still here is boldly heralded. Students of the gymnastics of the money market are wondering how far the overpowering rush upward of bond quotations will go. It seems wholly probable that, though in the near future the velocity of the upward movement will be checked, there will for an indefinite period be a slow, almost imperceptible, continuation of the rise, interrupted by reactions indigenous to the market place.

THE future of Dona prices turns very largely on the future of business, for when trade revives fully it will begin to demand larger draughts of money. The banks will then conceivably become sellers instead of buyers of investment securities. Moreover, individuals and corporations which to-day have surplus, idle funds temporarily invested in outside securities, will probably as trade expands need increasing proportions of their savings to finance their own commercial operations.

Even after the course of the stream of banking funds is reversed in direction and withdrawn to some extent from securities for strictly commercial uses, there will be influences to minimize the movement. A marked improvement in business would heighten the demand for funds, it is true, but it would also release frozen loans which at present cannot be paid off because borrowers have been suffering from hard times.

Commercial credit during these days of unemployment and slackness is temporarily doing part of the job of investment funds. The army of'investors, those who amass securities, increased enormously during the war and subsequently, and the heightened number of savers is an important factor'in the present flood of funds to the market.

There are offsetting factors.

First, taxes. Surtaxes and supertaxes make the purchase of taxable bonds unprofitable for the ultra wealthy and diminish the net return to even the fairly well to do.

Secondly, as is well known, in the cauldron of molten world forces loosened by the war, America was transformed from a debtor to a creditor nation. Instead of borrowing from abroad, the United States now exports capital everywhere. The competition of foreign demand for investable capital will tend to keep interest rates at home relatively high and domestic bond prices from rising to infinity. But this influence is modified by the revived ability of London to underbid New York on some foreign issues.

Apart from theory, the time has come for the ordinary investor to seek to orient himself. He should recognize that a revolution has occurred in investment values. The language of December, 1920, and even June, 1921, bond quotations is dead. The return on bonds is distinctly lower.

View Full Issue

View Full Issue

Subscribers have complete access to the archive.

Sign In Not a Subscriber?Join Now